sacramento property tax rate 2021

A delinquency penalty will be charged at the close of the. The current total local sales tax rate in Sacramento CA is 8750.

Please make your Property tax payment by the due date as stated on the tax bill.

. What is the sales tax rate in sacramento california. The Sacramento sales tax rate is. A county-wide sales tax rate of 025 is applicable to localities in Sacramento County in addition to the 6 California.

View the E-Prop-Tax page for more information. The combined tax rate of 875 consists of the california sales. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025.

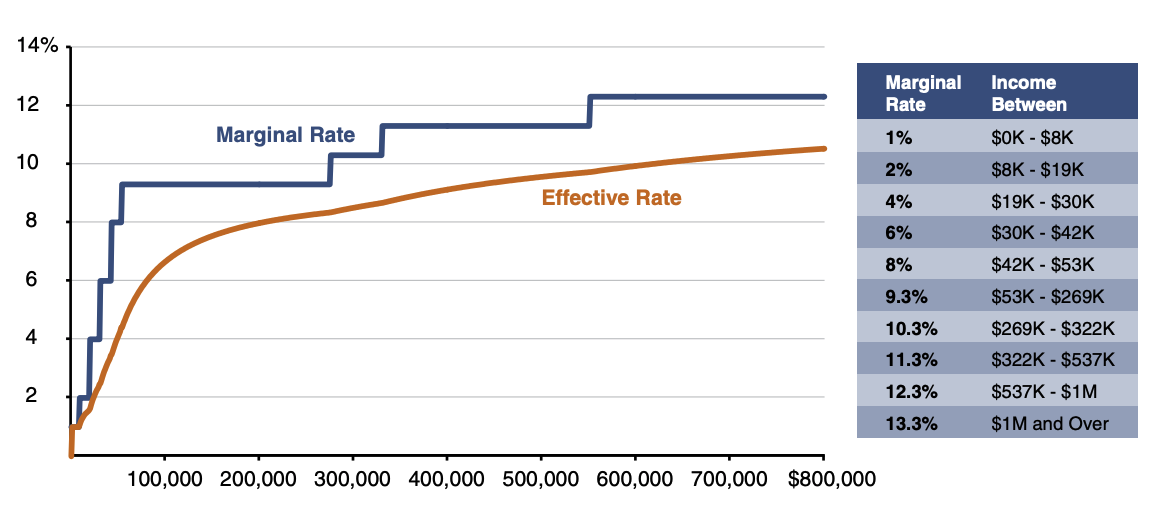

The overall property taxes in California are below the national average at 73. 31 2021 additional collection costs and monthly penalties at the rate of 15 percent will be added to the base tax. Sacramento County collects on average 068 of a propertys.

If a tax bill remains unpaid after Oct. While maintaining statutory restraints prescribed by law Sacramento creates tax rates. This is the total of state county and city sales tax rates.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Sacramento property tax rate 2021 Sunday May 29 2022 Edit. Payments may be made by.

The property tax rate in the county is 078. 2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1. Average property taxes paid rose 4 in 2020 according to data from real estate information firm attom data solutions.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. What is the sales tax rate in Sacramento California. The minimum combined 2022 sales tax rate for Sacramento California is.

Some property owners in san diego city have a 117461 tax rate while some in chula vista have a rate of 114221. The current total local sales tax rate in Sacramento CA is 8750. This is the total of state county and city sales tax rates.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. 31 2021 additional collection costs and monthly penalties at the rate of 15 percent will be added to the base tax. For property taxes via mail online or telephone.

Sacramento Property Tax Rate 2021. So how does the Sacramento county property tax rate differ from the state and national rates. As well explain further estimating property billing and taking in payments conducting compliance.

Sacramento County collects on average 068 of a propertys assessed fair market. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The total sales tax rate in any given location can be broken down into state county city and special district rates.

ERAF Property Tax Revenue Shift Estimate for Fiscal Year 2018-2019 ERAF Property Tax Revenue Shift Estimate for Fiscal Year 2019-2020 ERAF Property Tax Revenue Shift. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year.

Secured Property Taxes Treasurer Tax Collector

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Cryptocurrency Taxes What To Know For 2021 Money

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Paying Off Student Loans Debt Ratio

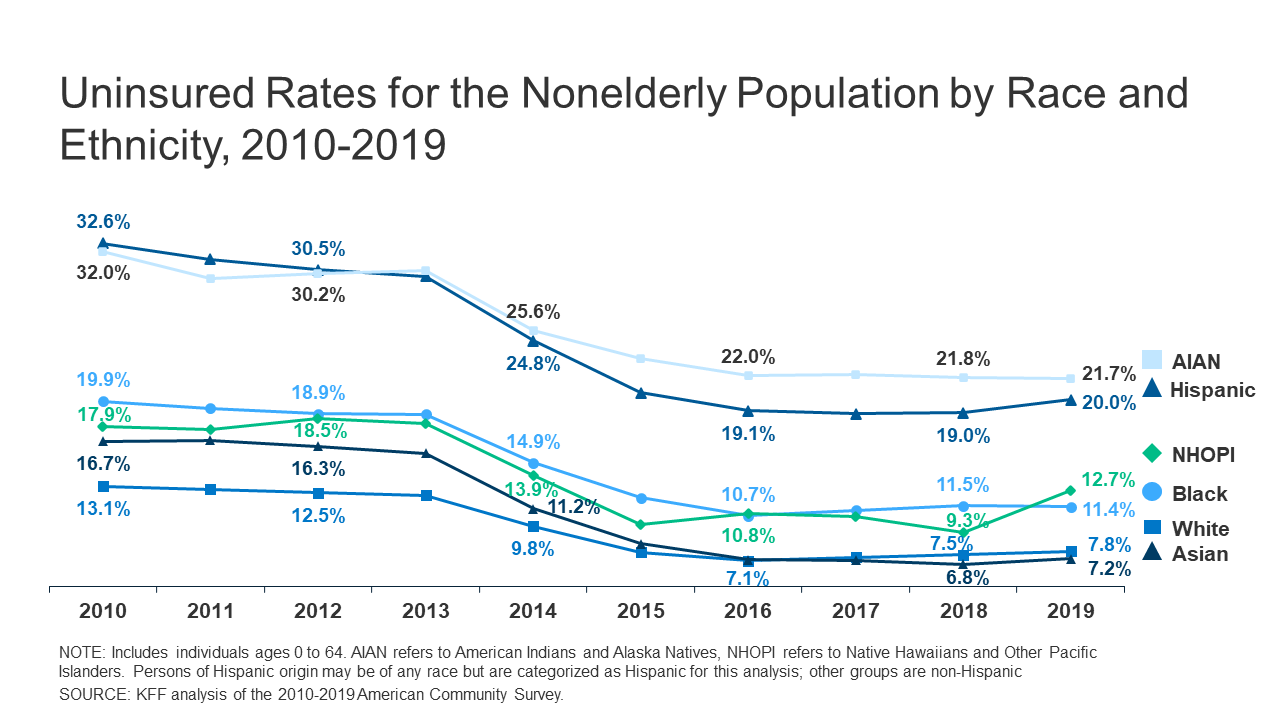

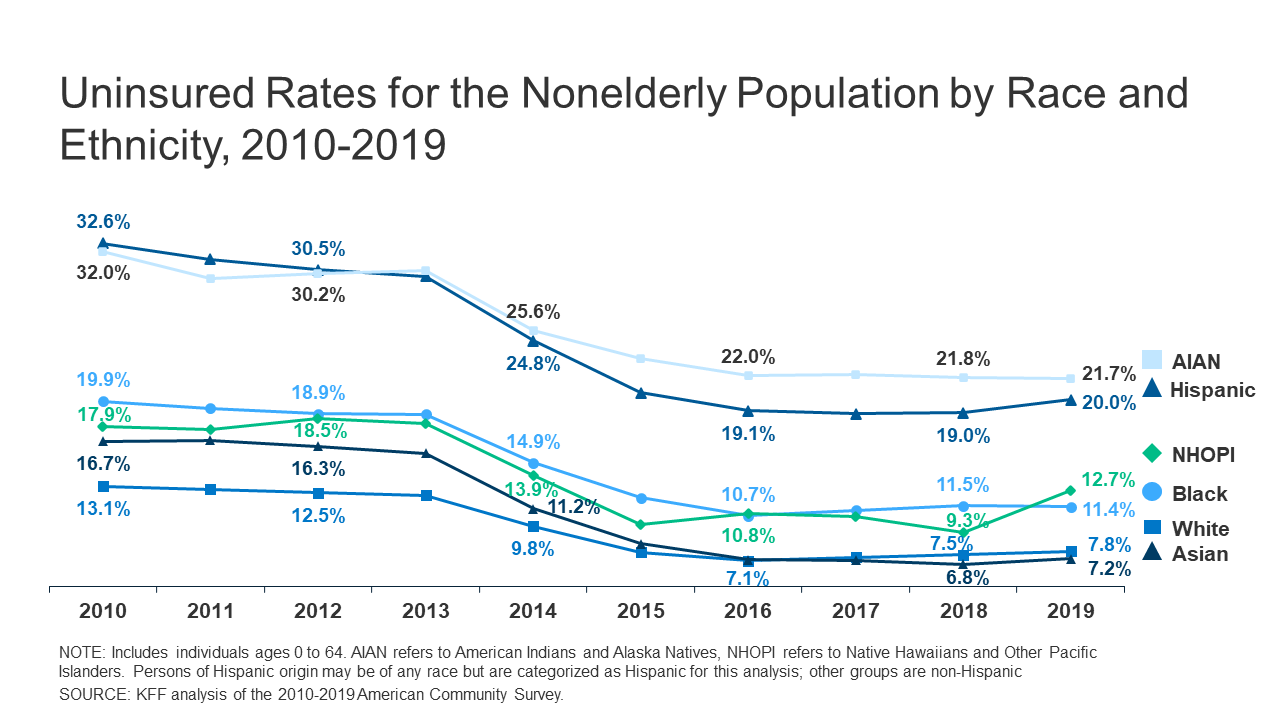

Health Coverage By Race And Ethnicity 2010 2019 Kff

Property Taxes Department Of Tax And Collections County Of Santa Clara

Fed Raises Rates Half A Point As It Tries To Tame Inflation The New York Times

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

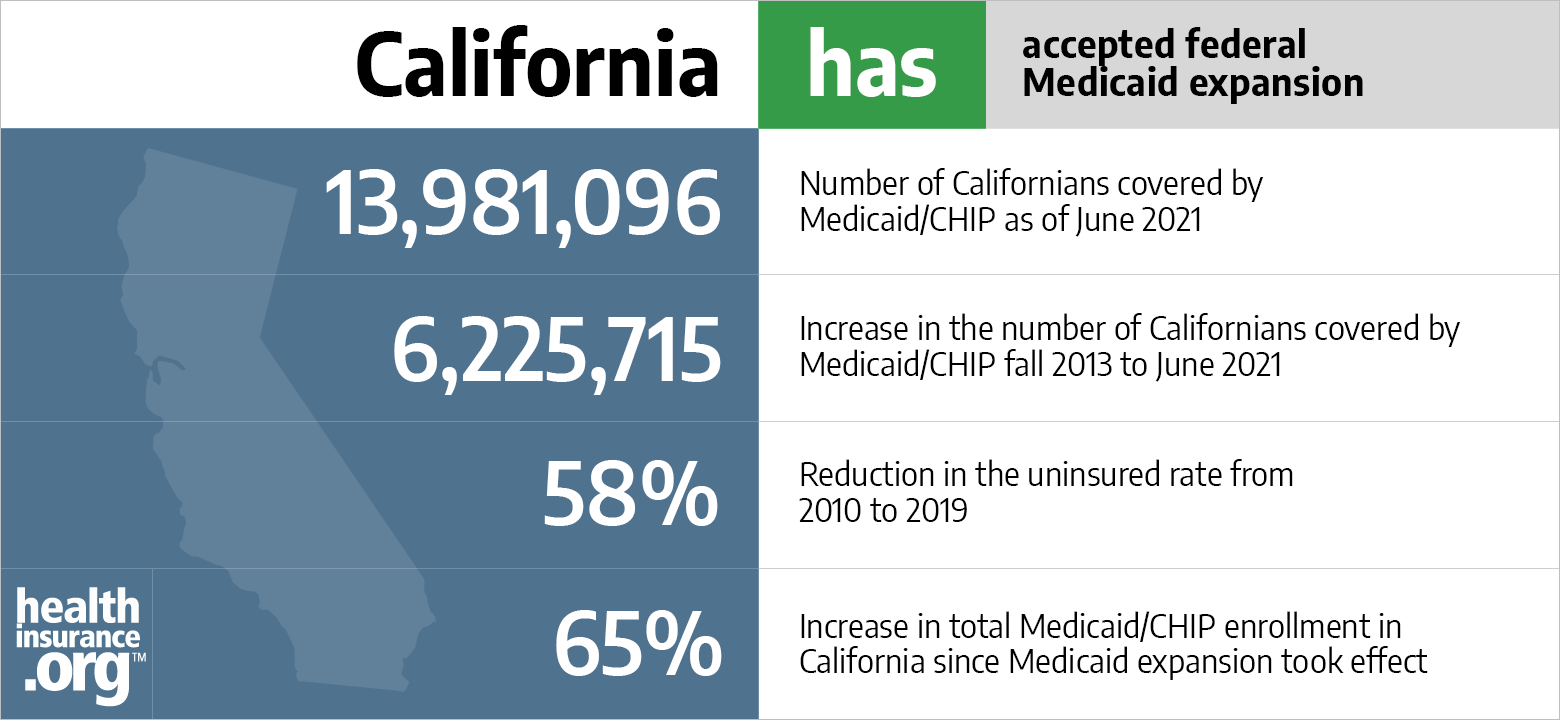

Aca Medicaid Enrollment In California Updated 2022 Guide Healthinsurance Org

Sacramento County Transfer Tax Who Pays What

Secured Property Taxes Treasurer Tax Collector

Alameda County Ca Property Tax Calculator Smartasset

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Online Map Sacramento County California Usa Sacramento County Map County

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow